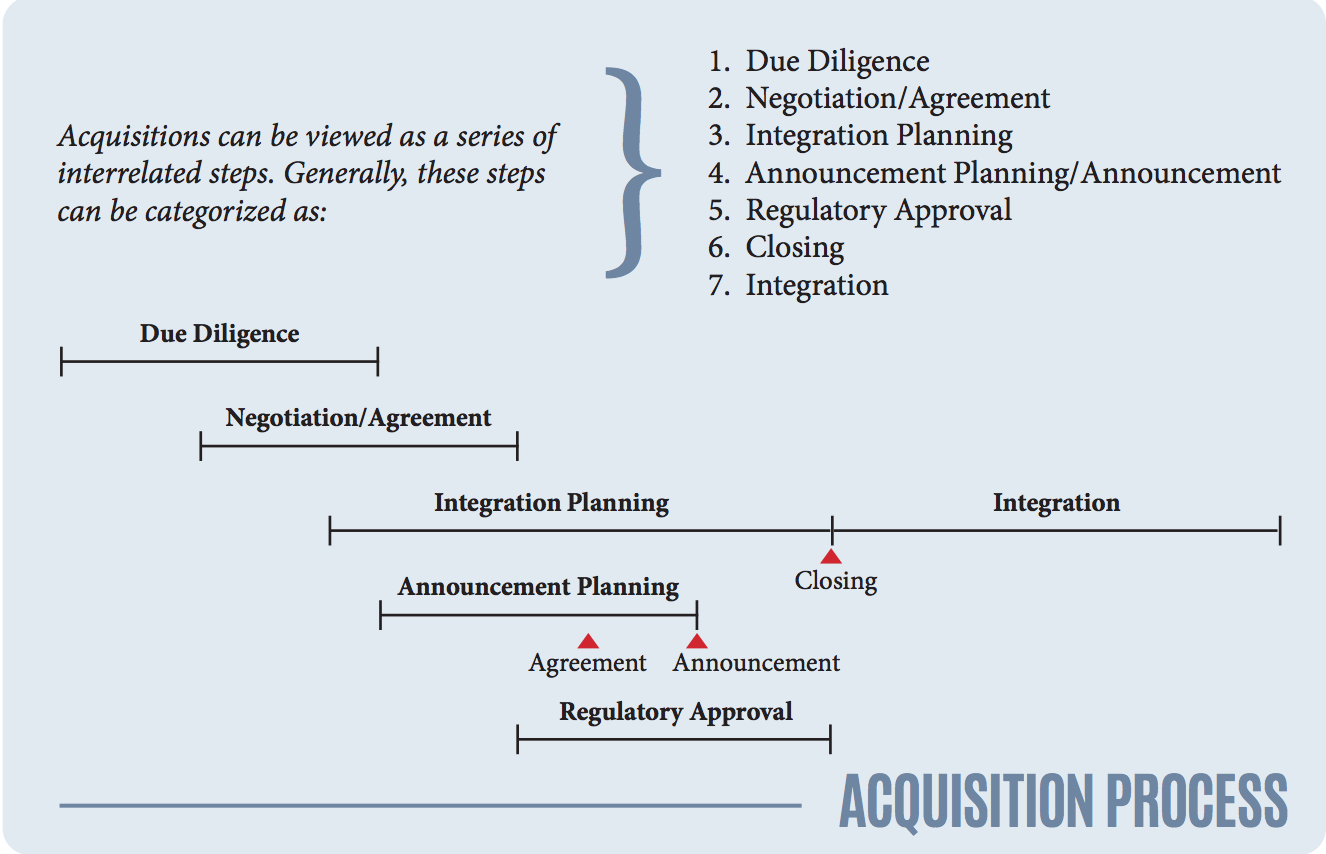

Overview of M&A

Employees are typically curious for information about the steps of a merger. This article explains the merger & acquisition process in a simple, concise manner.

Due Diligence

- During Due Diligence, information is collected:

- To assist in the valuation of an acquisition target.

- To uncover any risks that may exist (e.g., existing or potential legal liabilities).

- To reveal opportunities for additional growth or profitability that have not been capitalized on by the organization being evaluated for purchase.

Due Diligence can be divided into:

- Public Due Diligence—collection of information that already exists in the public domain

- Inside Due Diligence—collection and analysis after contact has occurred between the companies

Describe Negotiation/Agreement

- Both organizations begin formulating an Agreement as Due Diligence information is collected.

- This step includes the different levels of Agreement that may be signed as the deal progresses, such as:

- Letter of Intent

- Definitive Purchase Agreement

Describe Integration Planning

- During this step, detailed Integration Plans are developed. These plans identify the priority items to be addressed operationally after the deal is closed.

- Typically, teams of people (e.g., Task Forces) organized around key functions or processes develop these Integration Plans and present recommendations to a Steering Committee for approval.

- These plans include detail on such things as:

- Facilities consolidation or expansion

- Benefits changes

- Marketing material changes

- Organization adjustment, and/or systems integration

Describe Announcement Planning/Announcement

- Announcement Planning begins as soon as there is a significant probability that the deal will be consummated.

- Because the goal at Announcement should be to anticipate and answer as many questions as possible for employees and other stakeholders, it is extremely advantageous to have completed some level of Integration decision-making before Announcement.

Describe Regulatory Approval

- Various regulatory approvals may be required for a deal to be finalized.

- Depending on the regulations that apply, the magnitude of the deal, and the parties involved, approvals can take anywhere from a couple of weeks to more than a year.

- Approvals are generally coordinated by the legal and financial functions within an organization.

- Examples of approvals that may be required include:

- SEC

- FTC

- Industry regulatory body approvals

- Legal filings to comply with local, state, and/or federal laws

Describe Closing

- Once all regulatory approvals have been received and all parties have met the terms and conditions of the Definitive Purchase Agreement, the deal can be closed.

- At closing, shares of equity are exchanged to facilitate the change of control specified in the signed agreements.

- At this time, Integration implementation can begin.

Explain That The Timing Of Acquisition Steps May Vary

- The absolute and relative timing of acquisition steps can vary significantly from transaction to transaction.

- Generally, it is advantageous to begin Integration Planning as soon as possible.